This article first appeared in Firstlinks on 24/2/21

Investors concerned about the outlook for their balanced (60% shares/40% bonds) portfolios may need to consider alternate strategies to deliver their future investment objectives.

Specifically, the reasons for including a large allocation to bonds looks particularly challenged. Aside from meagre future return expectations, the ability of bonds to meaningfully appreciate during a crisis appears impaired for the foreseeable future. When preparing for the next crisis, investors will likely need to look further than bonds for negatively-correlated exposures.

Two such exposures that should appreciate during future crises include:

- Tail hedging – option positions that appreciate in bear markets, and

- Unhedged foreign currency exposures – a more simplistic defensive approach, but one that has delivered a negative correlation during a crisis.

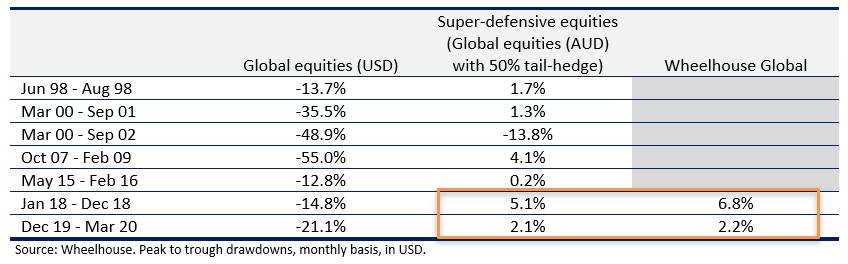

When integrated together within a global equity portfolio, these embedded features have consistently delivered a positive total portfolio return in Australian dollars during periods of peak to trough drawdown. We have coined the phrase ‘super-defensive equities’ to describe an equity strategy that includes both these negatively-correlated exposures.

In addition, the charts below help to illustrate some of the points made in the article:

Firstly, when we model ‘super-defensive’ equities (which we define as 50% drawdown plus unhedged Global exposure), they really have done well in an absolute sense during acute drawdowns over time. (We’ve only been around the last 2)

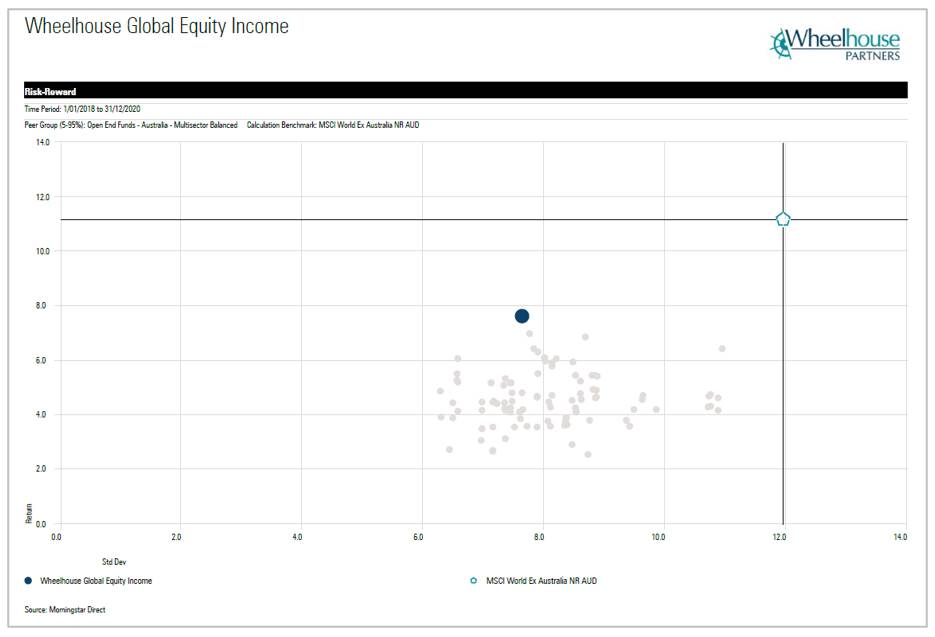

Secondly, while we don’t own any bonds, our risk looks similar to a balanced portfolio. In the scattergram chart we have plotted Wheelhouse Global vs the Morningstar multi-strategy (Balanced) peer group. On a go forward basis, we would expect future returns (and risk) to look quite different for portfolios holding passive bond exposures (vs the last 3 years).