Target Volatility ~ 8%pa & Target Total Return 8%+pa

The Fund is managed with a risk targeted approach, designed to deliver consistent positive absolute returns over rolling five-year periods. The fund has a volatility (risk) target around 8% or lower and targets a total return of 8%+.

The Fund owns a portfolio of global listed securities and option exposures providing investors access to alternative sources of return outside of traditional assets such as equities or fixed income and as a result, a return profile that is intended to be less capital growth dependent than a traditional equity portfolio.

The fund also has access to the risk management and investment expertise of Wheelhouse who adopt investment techniques that may not be available to all investors.

| Portfolio focus | The Fund is managed with a risk-targeted approach, designed to deliver consistent positive absolute returns over rolling five-year periods. |

| Fund objective | The Fund’s objective is to generate long-term returns in excess of the RBA cash rate plus 2.5%, over a rolling five-year period (net of fees and expenses of the Fund and before tax). |

| Targeted risk | Volatility (Risk) targeted to be approximately 8% or lower over rolling five-year periods |

| Targeted return | Wheelhouse targets a total return of 8%+ (net of fees and expenses and before tax) |

| Alternative source of returns | Access to alternative sources of return outside of traditional assets such as equities or fixed income and as a result a return profile that is intended to be less capital growth dependent than a traditional equity portfolio. |

| Regular incomes | Aim to provide regular income distributions (expected quarterly) of around 7-8% annually. |

March 2024

| 1 mnth | 3 mnths | 6 mnths | 1 yr | 3 yrs (pa) | 5 yrs (pa) | Since inception p.a | |

|---|---|---|---|---|---|---|---|

| Return | 1.0% | 2.5% | 7.2% | 4.5% | 5.1% | 5.9% | 6.4% |

| RBA+2.5%* | 0.6% | 1.7% | 3.5% | 6.9% | 4.7% | 4.1% | 4.1% |

| Volatility | – | – | – | 6.8% | 7.3% | 7.4% | 7.6% |

Performance figures are net of fees and expenses. Inception date is 26 May 2017. Past fund performance is not indicative of future performance.

* The Fund’s benchmark is RBA +2.5% and is used for all time periods shown. From the Fund’s inception to 1 September 2023 the Fund’s benchmark was MSCI World ex Australia Index (AUD). The change in benchmark does not impact any fees the manager may earn and the Fund’s investment objective has not changed.

Click here to download and read the full Monthly Report.

March 2024

| 3 months | 6 months | 1 year | 3 yrs p.a | 5 yrs p.a | Since inception p.a | |

|---|---|---|---|---|---|---|

| Income | 2.0% | 4.1% | 7.8% | 8.0% | 8.0% | 7.7% |

Past fund performance is not indicative of future performance.

| Portfolio Manager | Alastair MacLeod and Andrew MacLeod |

| Inception date | 26 May 2017 |

| Stock range | 50-100 |

| Cash limit | 0-15% |

| Benchmark | RBA cash rate plus 2.5% |

| Fees and charges | Management fee: 0.79% p.a. (inc GST net of reduced input tax credits) There is no performance fee. Other expenses and indirect costs may also apply. Please refer to the PDS for more information. |

| Investment amount | Initial investment minimum: $10,000 Withdrawal minimum: $5,000 Subject to the Responsible Entity’s absolute discretion |

| APIR code | BFL3446AU |

| Currency | Managed |

| Target Market Determination (TMD) | Download PDF This Fund is appropriate for investors with “Medium” risk and return profiles. A suitable investor for this Fund is prepared to accept medium risk in the pursuit of income generation alongside capital preservation with a medium to long investment timeframe. Investors should refer to the Target Market Determination (TMD) for further information. |

| Key risks | All investments are subject to risk which means the value of investments may rise or fall, which means that you may receive back less than your original investment or you may not receive targeted income. The key risks associated with investing in the Fund include liquidity risk, investment risk, credit and default risk, credit margin risk, investment strategy risk, related party risk, legal and regulatory risk (amended as required). Refer to section 4 of the PDS for a comprehensive summary of potential risks. |

| Responsible Entity | The Trust Company (RE Services) Limited (Perpetual) AFSL 23510 Level 18 Angel Place, 123 Pitt St, Sydney NSW |

For the latest prices, please download the Unit Price History file here.

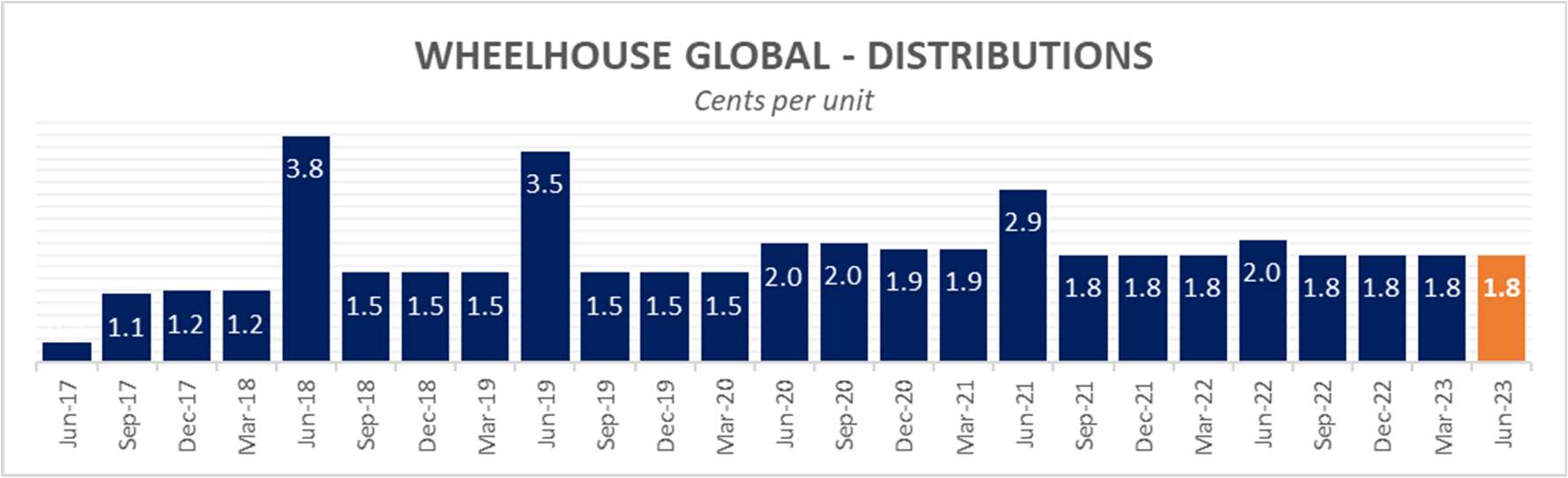

| June 2023 Distribution CPU | 1.8c |

| CUM distribution exit price ($AUD) | 0.9293 |

| Ex distribution exit price ($AUD) | 0.9115 |

| Ex distribution price used for reinvestment ($AUD) | 0.9142 |

Past fund performance is not indicative of future performance.

Product Disclosure Statement (PDS) – download PDF

Additional Information Booklet – download PDF

Request a copy of the Delta Research Report

Target Market Determination – download PDF

You can invest in a number of ways:

- Online application – click here to apply online.

- Direct Investment – click here for the application form and process.

- Apply via a platform. A platform bundles together a range of managed funds and investments into a single product. This provides investors consolidated and centralised reporting. The Wheelhouse Global Fund is available on the following platforms:

- BT Panorama and BT Wrap (Super, IDPS)

- Wealth02

- Hub24 (Super, IDPS)

- Netwealth (Wrap Service, IDPS, Super Service)

- Powerwrap (IDPS)

- Praemium (IDPS)

- Macquarie Wrap

Contact the platform directly for further details.

What to expect from Alternatives

“Alternative investments” refers to a group of investments distinguished from long-only investments in equites, bonds and cash. These investments are generally referred to as “traditional investments”.

Alternative investments include such assets as listed equity, private equity, derivatives, real estate, private credit and commodities among other investments. A key distinguishing aspect of Alternative investments is they can include non-traditional approaches to investing in traditional assets, importantly providing investors access to an alternative source of investment returns.

This alternative risk premia can be found embedded within traditional assets. We seek to target this different risk premia and utilising our expertise to re-shape the return profile of this traditional asset and target a set level of risk.

What to expect from an Allocation to Alternatives:

- Unique source of returns – not Beta driven

- Risk/Return – a profile that is between Equities and Fixed Income

- Enhance Portfolio Risk Management – low co-variance to other strategies

- Provide Portfolio Diversification – low co-variance to other strategies

- Consistency – repeatable process and outcomes

- Competitive fee structure and no performance fee

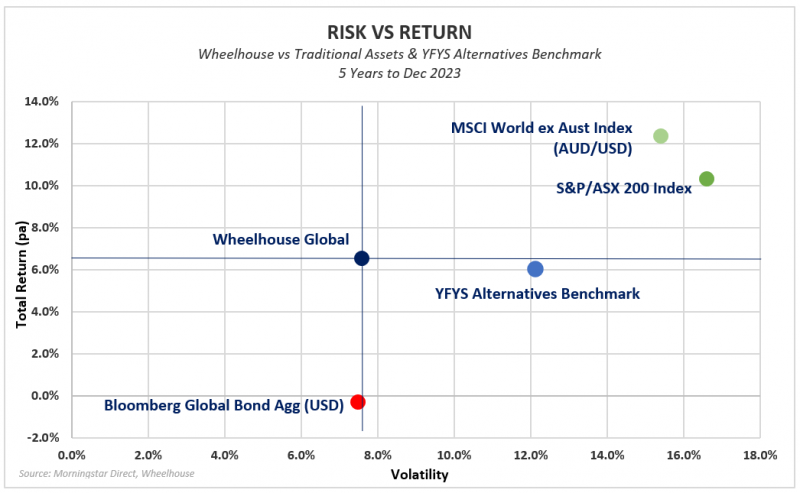

Wheelhouse Global - sitting in the right spot

Solid risk/return outcomes

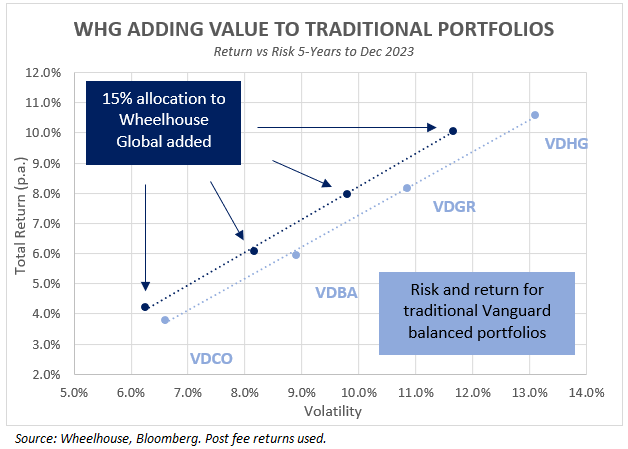

A positive impact to a stock/bond portfolio

The chart below highlights the diversification benefits of a 15% allocation to Wheelhouse Global, alongside a range of Vanguard traditional risk profiled portfolios for the period outlined (since common inception).

VDCO: Vanguard Diversified Conservative Option (10/90)

VDBA: Vanguard Diversified Balanced Option (50/50)

VDGR: Vanguard Diversified Growth Option (70/30)

VDHG: Vanguard Diversified High Growth Option (90/10)

Request access the Alternatives Analysis:

Wheelhouse Global – Alternatives analysis portfolio positioning