- July 14, 2023

Dear fellow investor

We are pleased to advise that the Wheelhouse funds will pay the following distributions to investors for the quarter to 30 June 2023.

| Fund Name | Jun ’23 Distribution cpu | Jun ’23 Indicative franking* cpu | Target annual yield (%) | Last 12m yield (%) | |

| Wheelhouse Global Equity Income Fund | 1.807c | n/a | 7-8% | 7.8% | |

| Wheelhouse Australian Enhanced Income Fund | 1.009c | 0.37c | 8-9% (5-6% cash & 3% franking) | 10.9% (7.2% cash & 3.7% franking) |

Source: Wheelhouse. Targeted yields are not guaranteed

The funds’ unit prices on the 30th June will be adjusted for the cash distribution amount above. Franking is not included in the unit price so there is never any adjustment for franking.

The monthly newsletter and performance reports for both funds will be published by mid-July.

Distribution history

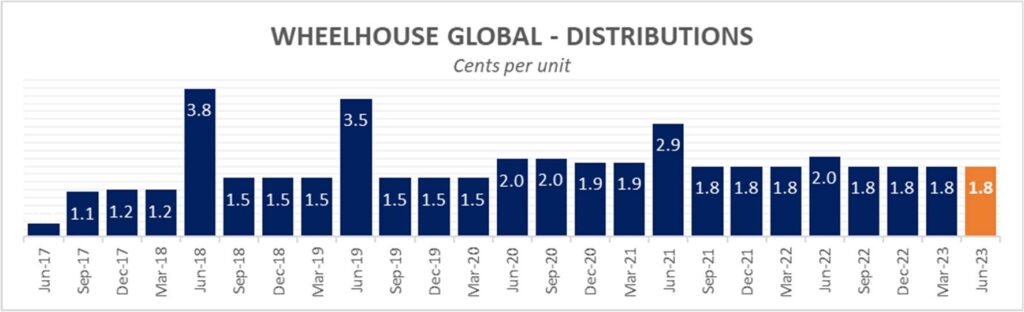

Wheelhouse Global

The December 2022 distribution marks the 24th consecutive quarterly distribution from the fund which has consistently delivered 7-8% in annual income yield. Cumulatively since inception, the Fund has yielded over 45% during the roughly six-year history.

The Global Fund’s distribution is almost entirely comprised of income with minimal capital gains distributed.

This income-based distribution is by design, to ensure the distribution profile is sustainable even during

periods when realised capital gains may not always be available.

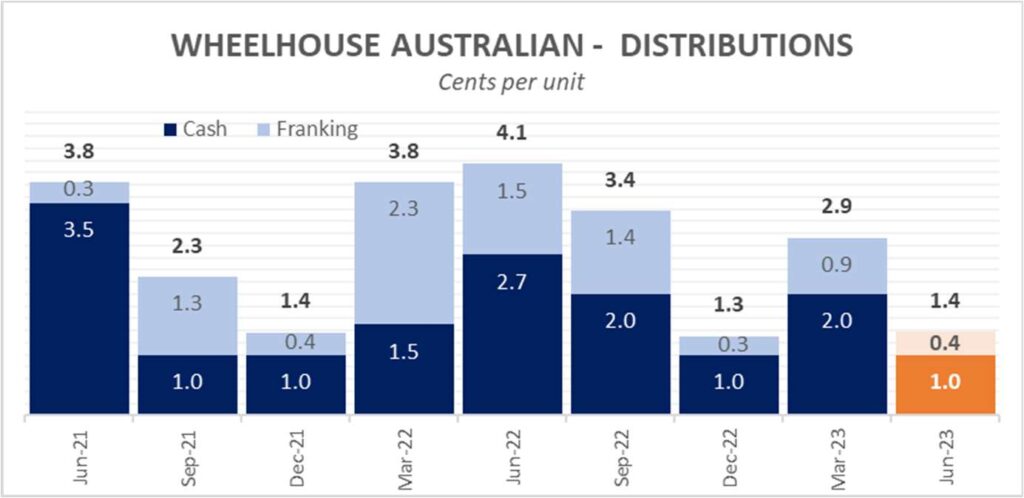

Wheelhouse Australian

Since inception, the Australian Fund has delivered an annualised distribution of 11.0%, comprising 7.0% in cash and 4.0% in franking.

This is little higher than our longer-term expectations, due in part some unusually high special dividends received from the banks and iron-ore miners, alongside some one-off benefits from corporate activity.

Looking forward, assuming dividend forecasts are delivered we believe 5-6% is a realistic expectation for cash income and around 3% for franking, which represents roughly twice the franking of the S&P/ASX200 Index. This capture of around 2x the markets fully franked yield is a unique feature of our Australian strategy.

With essentially zero turnover, we anticipate there will be minimal realised capital gains to distribute in a typical quarter.

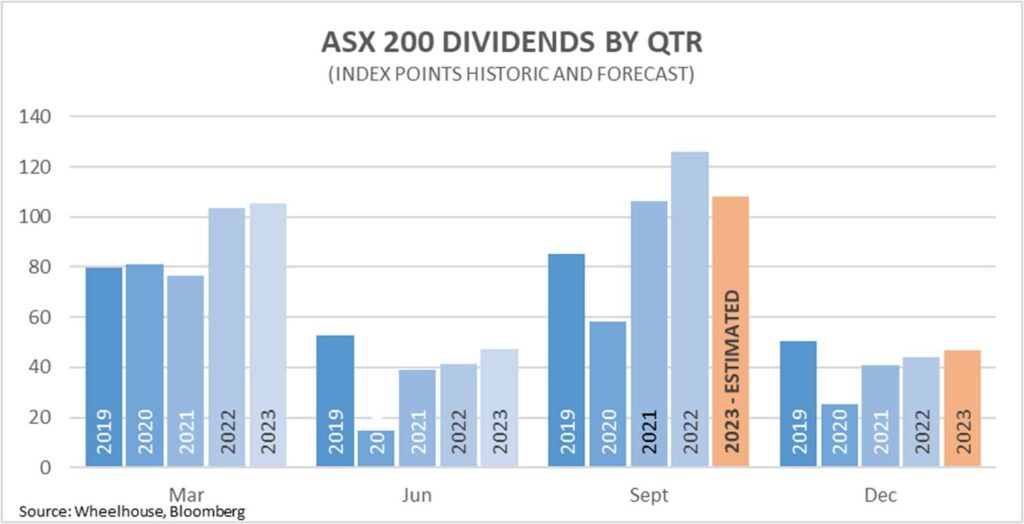

The Australian market (S&P/ASX200 Index) appears to be expecting a traditional bumper third quarter dividend payout, driven by the iron-ore market heavyweights and CBA. We have no reason to believe these forecasts will be materially different to reality, with the captured dividends and franking distributed by the Fund in the September quarterly distribution.

Returns for a lower growth world

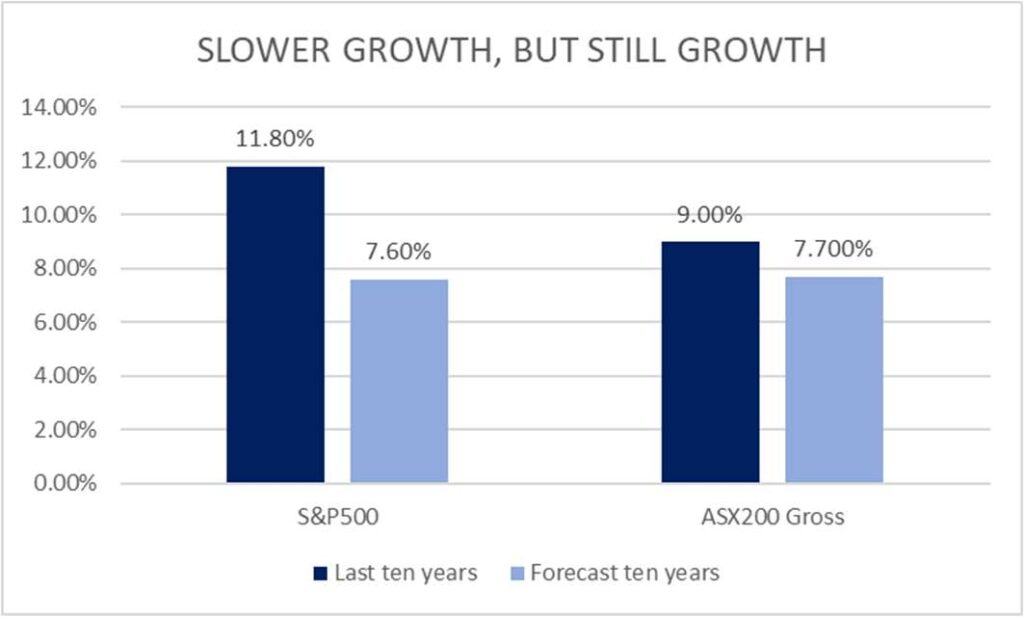

In our recent monthlies we’ve written about what we believe will be an increasingly difficult environment for investors, as future market returns may well be lower than what we have come to expect in recent decades.

This view was recently supported by a Federal Reserve working paper(1) in the US, which suggested that without the twin benefits of lower corporate taxes (helping margins) and declining interest rates (helping price multiples), investors should prepare for a period when equity market returns should approximate GDP growth… or 2% annually.

We’re not this bearish at all, however we do think growth will moderate from what we’ve recently experienced, particularly in the US. The return expectations below are sourced from Blackrock’s capital market assumptions, in Australian dollars.

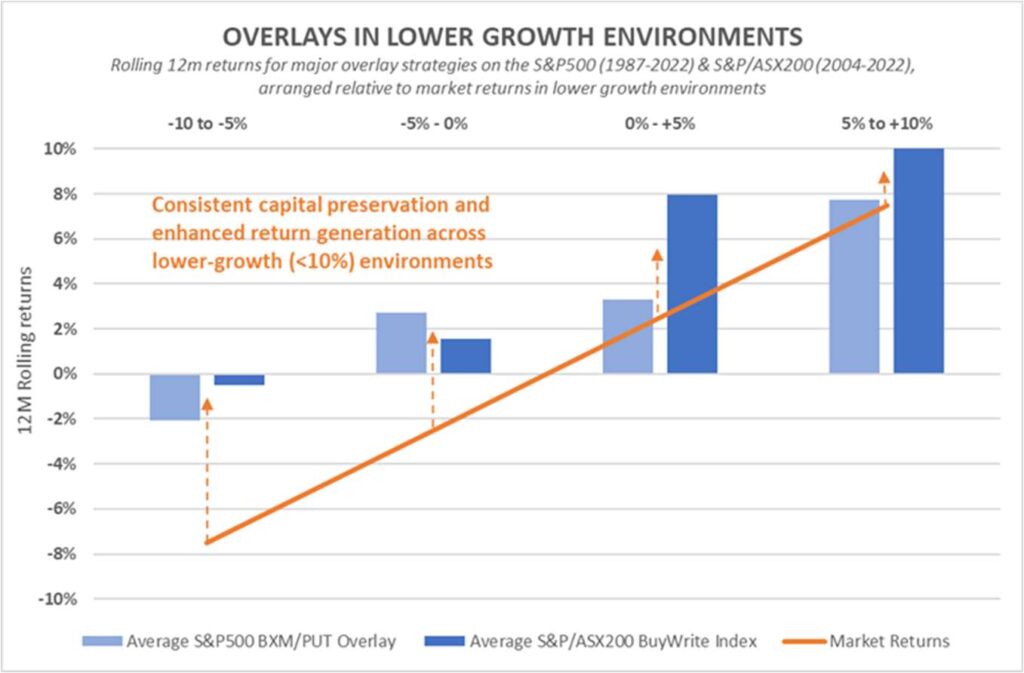

As we discuss in our most recent monthly, overlay strategies which source additional returns from alternative income have historically performed well during these lower growth environments. While no guarantee this will always be the case, the returns have proven remarkably repeatable across time periods and regional markets.

The chart below plots historical returns of systematic overlay strategies (that we specialise in), versus owning equities directly. In environments of less than 10% growth annually, returns are generally enhanced. In environments of negative returns, capital is preserved far more effectively than owning shares directly.

Even if we’re wrong and equity market growth is more positive than we’re expecting, there is reasonable participation in the upside.

With a little help from higher income generation from overlays and higher franking values from dividends, we believe a lower growth environment remains perfectly navigable.

Risk targeted investing

On behalf of the team at Wheelhouse, I would like to thank you for investing alongside us. With potentially more challenging markets ahead, we believe our unique risk-targeted approach that relies far more heavily on income generation throughout the investment cycle, should be well placed to navigate a future investment world of more muted market returns.

Please reach out to our Head of Distribution, Wayne McGauley, if you require any further information about your investment or about the two funds and the genuinely different roles that the play in an investors portfolio.

Yours sincerely,

Alastair MacLeod

Managing Director