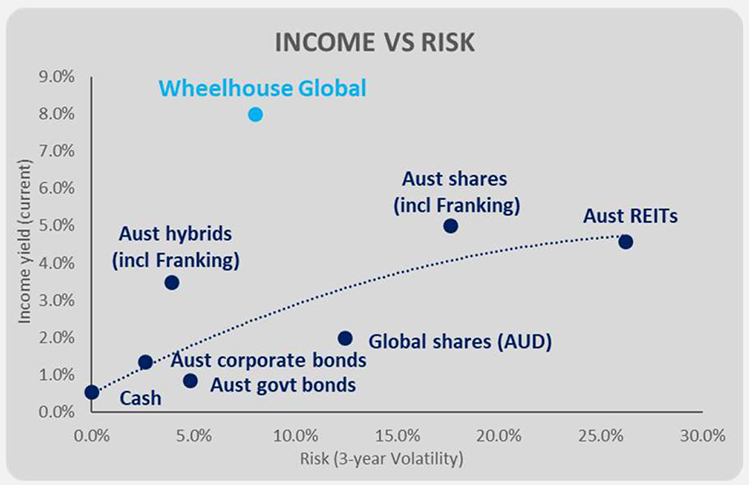

- Meagre yields from cash/bonds have left many investors reducing their usual weights to these defensive assets insearch of more acceptable returns.

- Investors have been pushed further along the risk curve and forced to shoulder meaningfully higher capital risk.

- Wheelhouse Global targets enhanced income efficiency – increasing income whilst minimising additional risk.

Source: Wheelhouse, Morningstar Direct. Asset proxies: S&P Australian Government Bond Index, S&P Australian Corporate Bond Index, Betashares Hybrid ETF, Vanguard Aust Property Securities ETF, S&P/ASX 200 Index, MSCI World ex Aust (AUD).

Risk-Efficent Income

Enhancing income yields typically entails some level of higher risk. By comparing yields across different asset classes, income can be evaluated alongside the associated increase in risk.

Selecting investments above the line should assist in building a more risk-efficient income portfolio.

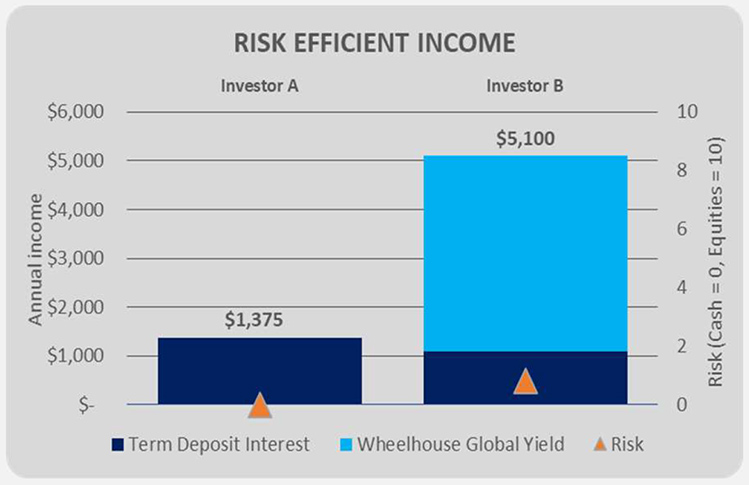

Source: Wheelhouse. Investor B assumes 20% allocation to Wheelhouse Global

Scenario Analysis

- Investor A: $250,000 invested in term deposit yielding 0.55% pa, and;

- Investor B: $200,000 invested in term deposit yielding 0.55% pa, plus $50,000 invested in Wheelhouse Global yielding 8.0% pa.

By introducing a 20% allocation to Wheelhouse Global from the investor’s cash allocation, the income yield increases 3.7x from $1,375 to $5,100 pa.

Of equal importance, the portfolio risk only increases from zero to 0.9, or less than one-tenth the risk of being fully invested in Australian equities.

The Wheelhouse Global Fund’s strategy was specifically designed with income efficiency in mind.

The Fund objective is to deliver a 7-8% income yield, while assuming half the risk of equity markets. As a result the Fund is the lowest risk equity fund in the Morningstar long-only universe, but also one of the highest yielding.

For more information on Wheelhouse and their income funds please refer www.wheelhouse-partners.com