As published on Livewire Markets, 14 July 2020

While all eyes have been focussed on falling dividends this year, there has been little discussion around the negative impact this will have on the franking credit benefits that are attached to these Australian yields.

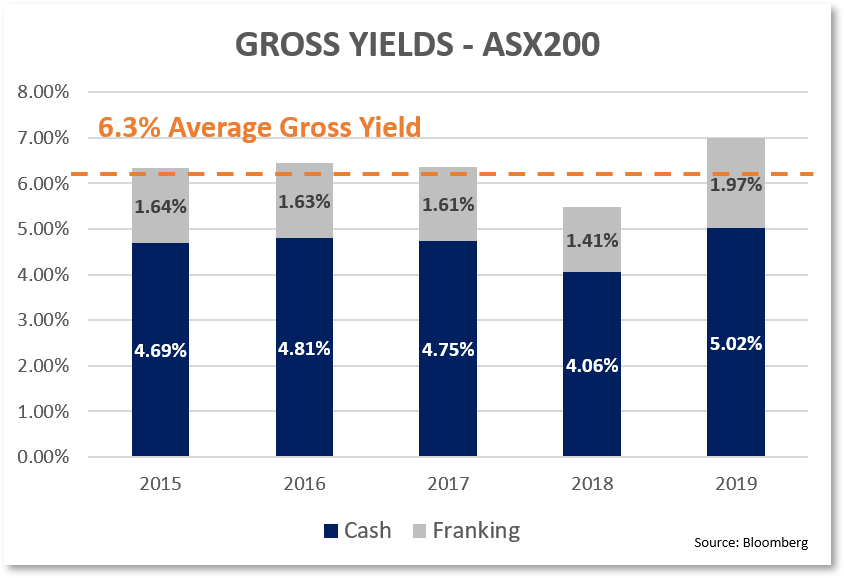

Franking credits provide an important source of cash return to many eligible investors, on average accounting for around 1.65% of total return over the past 5 years.

Investors would have been particularly pleased with calendar 2019, a bumper year for franking credits with nearly 2% returned as companies boosted dividend payments ahead of the Federal election. Franking credits are calculated and paid on a fiscal year basis, however analysis of the calendar year is useful to provide some guidance on where franking credit returns are likely to head in the future.

A more miserly 2020 for franking credits

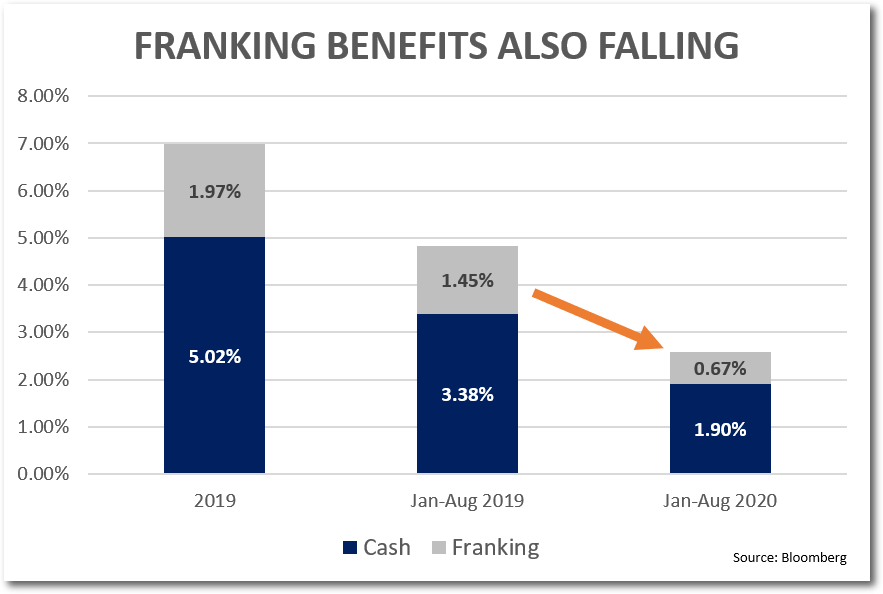

On this basis, returns from franking credits this year are likely to be far more miserly than 2019. We estimate that the calendar year to date contribution from cash dividends to shareholder return has fallen by over 40% for the 8 months to 31 August 2020, from the prior equivalent period.

Given the magnitude of the fall, a decline in franking credits is no doubt also expected. On our estimates, returns from franking credits this calendar year have only totalled 0.67% versus the 1.45% generated at the same point last year, with the percentage decline more than matching the decline in cash dividends.

The marked decline in franking benefits corresponds with the fact that the largest cuts to dollar dividends have been made to previously fully franked dividends, for the most part. The major cuts to bank dividends, which are all fully franked (except ANZ), in addition to the withdrawal of special dividends from BHP and RIO have all contributed to the material ‘shrinkage’ of the franking credit pool in 2020.

As these 6 stocks accounted for over 43% of the total cash dividend on the ASX200 in the past 12 months, and they were mostly all fully franked, the pool of fully franked dividends has declined more than the broader cash dividend generated by the ASX200 in percentage terms (as the broader index includes many stocks with partial or no franking credits attached, that did not see the same quantum of declines).