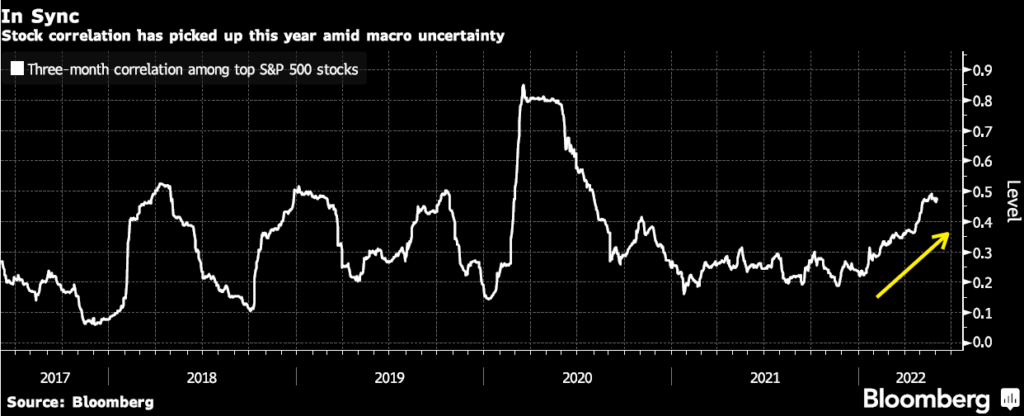

As market returns trend lower, many investors are waking up to the underlying risk in their portfolios. In recent years as interest rates have marched steadily towards zero, investors who rely on income have been forced further out along the risk curve in order to generate sufficient yield.

As a result, cash weightings for many investors are down and equity weightings are up… meaning overall portfolio risk is meaningfully higher. Hardly ideal as we potentially head into an economic slowdown, but there have been few other solutions for income starved investors.

Is there another way to capture full dividend yields, including full capital returns, but with less risk?

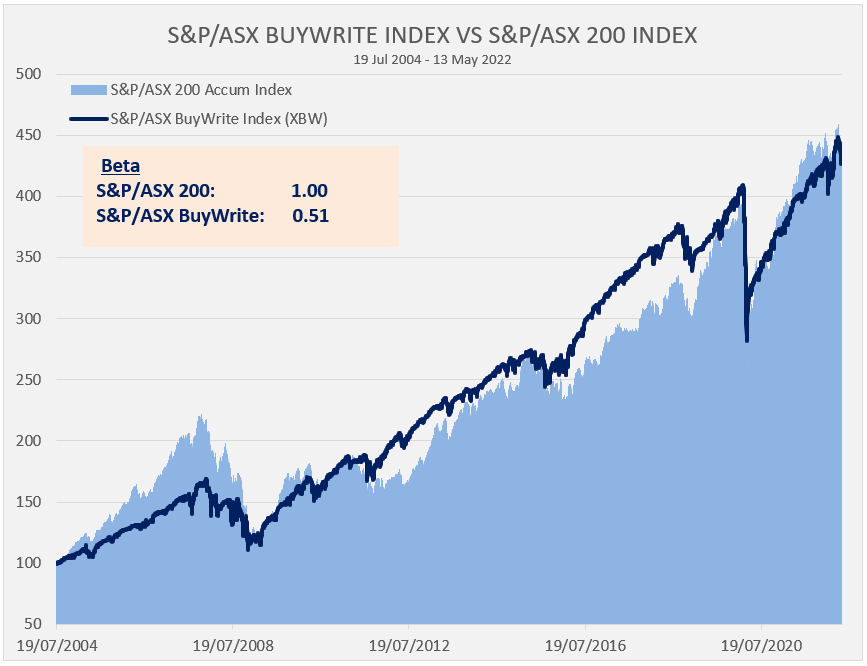

In this wire, we’ll introduce a systematic approach that for the past 18 years has captured the full dividend yield of the Australian market, and full equity returns, but has achieved this with around half the Beta (or risk) of the market. Later we’ll also introduce our Australian fund that uses this source of superior risk-adjusted returns to target alpha, or outperformance.